CREDIT INSURANCE

What you need to know

before selecting your policy...

FGI Risk specializes in all aspects of credit risk mitigation, ensuring that our customers receive the proper and complete coverage they need to protect their bottom line.

Schedule a Free Credit Insurance Consultation!

Why FGI?

Experience

- Tier-one broker.

- Over 20 years of experience in structuring and creating complex credit insurance programs.

Communication

- Provision of FGI’s licensed brokers to work closely with designated teams within each carrier.

- Development of specialized credit insurance agreements and riders for all needs.

Optimization

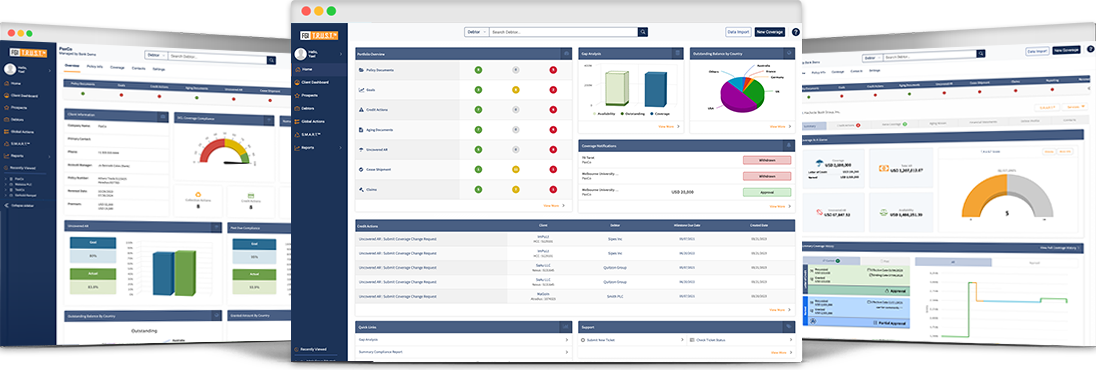

- Our credit insurance management platform, T.R.U.S.T.™, provides the latest technology to monitor and collect on credit insurance policies.

- Tasks of managing the nuances of each policy are outsourced.

FGI T.R.U.S.T.™: Combining Technology with Functionality to Mazimize Credit Insurance

Did you know that FGI can also help you manage your credit insurance policy?

With T.R.U.S.T.™ you will:

- Maximize the value of your credit insurance by effectively monitoring policy compliance in real time.

- Increase efficiencies and cost savings by monitoring policies from one central location.

- Reduce staffing requirements and errors associated with monitoring policies manually.

- Benefit from policy standardization and increased levels of policy management transparency.

We have worked with FGI for a long time and they are a great team. Their T.R.U.S.T.™ platform streamlines automation of our credit insurance monitoring process, allowing us to verify receivables more efficiently and accurately, which in turn allows us to provide optimal credit coverage to our clients. The immediate change alerts, insurer requests, claim deadline updates, and notification of potential policy risk helps ensure our clients will get paid on claims and protects against bad debts.

JULIE HALBERT

Business Credit Portfolio Manager,

Pathward